- Home

- / Finance

- / Tax Consulting

- / Tax Returns

- / I will do year end accounts and tax return for your company

I will do year end accounts and tax return for your company

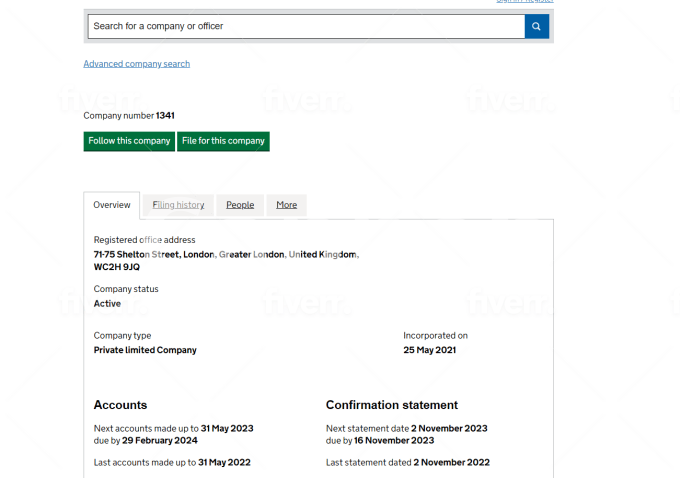

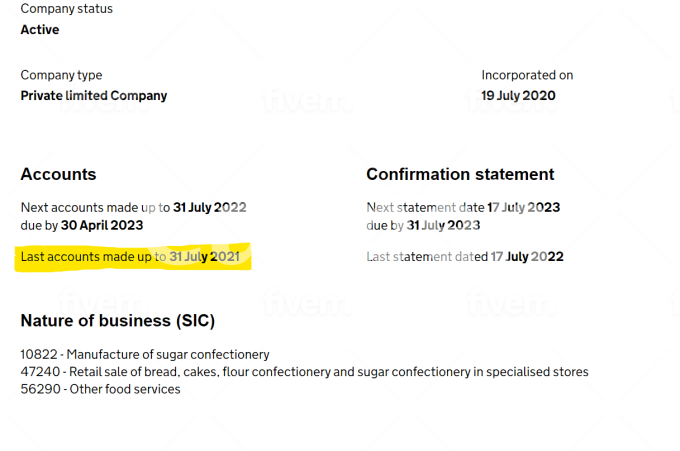

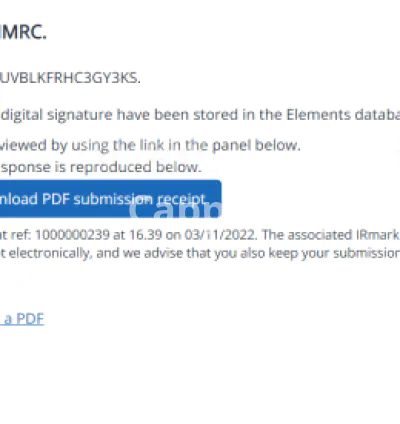

Our company specializes in providing professional year-end accounts and tax declaration services for UK-registered companies. We assist businesses in preparing and filing their Annual Financial Statements, also known as Year End Accounts or Company Accounts, alongside the Corporation Tax Return CT600. These submissions are legally required to be sent to Companies House and HMRC annually. Failure to comply can result in penalties, the risk of company dissolution, and potential legal consequences for the directors.

$485

No comments found for this product. Be the first to comment!